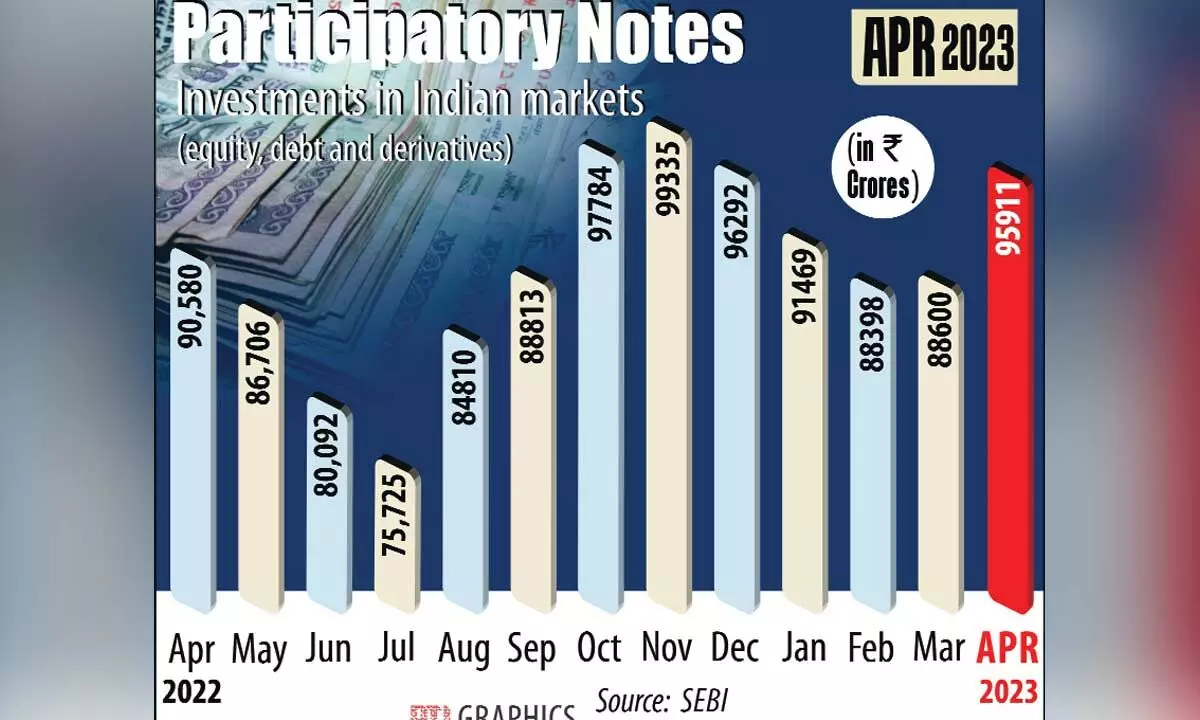

P-notes investments at Rs 95,911 cr in Apr

Equities accounted for Rs 86,226 cr, debt segment gets Rs9,586 crore and hybrid securities received Rs 100 cr; India’s robust economic growth and infrastructure development were primary drivers

image for illustrative purpose

New Delhi: Investments in the Indian capital markets through Participatory Notes (P-notes) were in upward trend in the past two months, with the number reaching Rs95,911 crore in April-end, primarily driven by the country’s robust economic growth.

This was the highest level since November 2022, when investment through the route stood at Rs 96,292 crore. Participatory notes (P-notes) are issued by registered Foreign Portfolio Investors (FPIs) to overseas investors who wish to be part of the Indian stock market without registering themselves directly. They, however, need to go through a due diligence process. According to Sebi data, the value of P-note investments in Indian markets -- equity, debt, and hybrid securities -- stood at Rs 95,911 crore at the end of April as compared to Rs 88,600 crore in March-end. Also, this was the second consecutive monthly increase in the investment level. Investment through P-notes was at Rs 88,398 crore in February-end and Rs 91,469 crore in January-end. The growth in P-notes generally aligns with the trend in FPI flows, when there is a global risk to the environment, investment through this route increases and vice-versa.

Shrey Jain, Founder and CEO, Sasonline, said that one of the primary drivers behind the growth in P-notes investment is India's robust economic growth, which positions the country as an appealing destination for FPI investments.

“Another contributing factor to the growth in P-notes investment is the rapid development of infrastructure including transportation, logistics, energy, and digital infrastructure. These initiatives not only address critical gaps, but also provide investment opportunities for FPIs in sectors such as construction, engineering, and renewable energy,” he said.

According to him, the rise in P-note investments can be attributed to various other factors, including a substantial consumer base, significant market potential, and a demographic advantage, among others. Of the total Rs 95,911 crore invested through this route till April this year, Rs 86,226 crore was invested in equities, Rs 9,586 crore in debt and Rs 100 crore in hybrid securities. In addition, assets under custody of the FPIs grew to Rs50.85 lakh crore in April from Rs48.71 crore in the preceding month. Meanwhile, FPIs invested Rs11,631 crore in the Indian equities in April and Rs806 crore in the debt market.